NY AU-432 2011-2025 free printable template

Show details

AU-432 10/11 SURETY ACKNOWLEDGMENT State of County of On this in the year SS. before me personally came to me known name of attorney in fact who being duly sworn did depose and say that he/she resides in that he/she is the attorney in fact duly appointed of the if the place of residence is in a city include the street and street number if any thereof the corporation described in and which executed the attached instrument as surety that he/she...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form au 262 55

Edit your au 262 55 income allocation questionnaire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ny au 262 55 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form au 262 55 income allocation questionnaire online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ny form au 262 55. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new york au 262 55 form

How to fill out NY AU-432

01

Obtain Form NY AU-432 from the New York State Department of Taxation and Finance website or at your local tax office.

02

Fill out your personal information at the top of the form, including your name, address, and taxpayer identification number.

03

Indicate the type of exemption you are applying for by checking the appropriate box.

04

Provide detailed information concerning the property for which you are seeking an exemption, including its location and a description.

05

If applicable, include any supporting documentation required for the specific exemption.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the completed form to your local assessor's office by the specified deadline.

Who needs NY AU-432?

01

Individuals or organizations seeking property tax exemptions in New York.

02

Homeowners who are applying for certain property tax benefits.

03

Businesses looking to qualify for specific property tax exemptions.

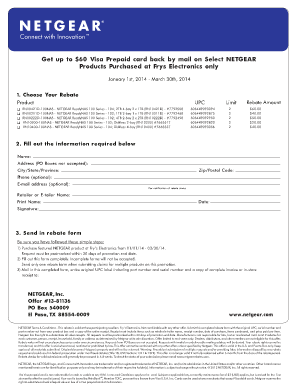

Fill

new york form au 262 55

: Try Risk Free

People Also Ask about au 262 55 form

Do I have to pay NY state income tax if I live in another state?

For most people this is straightforward: the primary residence where you live is both your state of domicile and the state in which you are a resident for tax purposes. However, you can still be considered a resident of New York State for income tax purposes even if you are not domiciled in the state.

What is the standard deduction for 2023 in NY?

What is New York state's standard deduction? The standard deduction allows taxpayers to reduce their taxable income by a fixed amount. The New York state standard deductions for tax year 2022 (taxes filed in 2023) are: Single: $8,000.

How to avoid NYC city tax?

For example, you can avoid NYC income taxes if you live in New Jersey and commute to work in the city. And you can reach Manhattan in as little as thirty minutes from cities like Hoboken, Jersey City, or the many suburban towns in NJ.

What services are exempt from sales tax in New York?

Sales tax also does not apply to most services. Examples of services not subject to sales tax are capital improvements to real property, medical care, education, and personal and professional services.

Do you pay city tax if you don't live in NYC?

Nonresidents of New York City are not liable for New York City personal income tax. The rules regarding New York City domicile are also the same as for New York State domicile.

Do you pay city tax in NYC?

The City Sales Tax rate is 4.5% on the service, there is no New York State Sales Tax. If products are purchased, an 8.875% combined City and State tax will be charged. The City charges a 10.375% tax and an additional 8% surtax on parking, garaging, or storing motor vehicles in Manhattan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nys au 262 55 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your NY AU-432 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit NY AU-432 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing NY AU-432, you need to install and log in to the app.

How do I complete NY AU-432 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your NY AU-432. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NY AU-432?

NY AU-432 is a form used by businesses to report and calculate their sales tax for transactions involving the use of tangible personal property or services in New York.

Who is required to file NY AU-432?

Businesses that make sales of tangible personal property or taxable services in New York and are registered with the New York State Department of Taxation and Finance are required to file NY AU-432.

How to fill out NY AU-432?

To fill out NY AU-432, businesses need to provide details such as the total sales, the taxable sales amount, the sales tax collected, and other necessary information related to transactions during the reporting period.

What is the purpose of NY AU-432?

The purpose of NY AU-432 is to facilitate the reporting and remittance of sales tax collected by businesses to the New York State Department of Taxation and Finance.

What information must be reported on NY AU-432?

On NY AU-432, businesses must report total sales, taxable sales, exemptions claimed, sales tax collected, and any other relevant financial details pertaining to their taxable transactions.

Fill out your NY AU-432 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY AU-432 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.